Pumps & Systems

April, 2007

Observations on the changes, trends and challenges that both suppliers and pump users may face in the coming years.

Changes

Perhaps the most pronounced change we have experienced is that the customer we serve is no longer a “local” customer, but is increasingly a large national or global organization with locations throughout the world.

These global customers are interested in working with suppliers that can provide a comprehensive range of specialized services with a high degree of professionalism. Because they are interested in reducing the number of suppliers with which they work, they often prefer to deal with suppliers that can effectively service multiple locations.

Over time, this will change the landscape of aftermarket suppliers, with smaller, local organizations being reduced. The aftermarket providers that emerge from this period of change will be larger companies with broader capabilities and services, particularly those that are strong in engineering and technical services and in employing new technologies.

When industrial capital projects in the U.S. were in a slump during the 1980s and 1990s, a dramatic consolidation of pump companies resulted in only a few major broadbased OEMs dominating the industry. Today, the pump industry enjoys resurging demand – new power plants, major refinery expansions, oil sands projects in Canada and so on – that is straining productive capacity, with deliveries for both pumps and replacement parts often exceeding acceptable parameters.

This strain, in turn, creates opportunities for qualified aftermarket parts suppliers.

Trends

The focus of our business is no longer the “machine shop,” but rather technological improvements that continue to change and advance the way we operate.

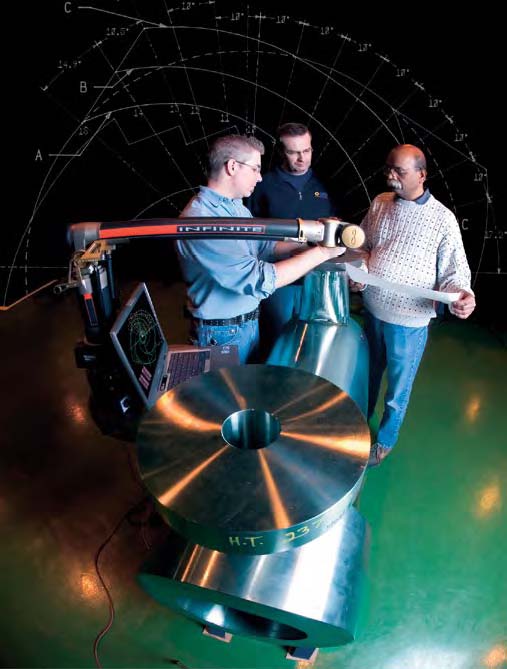

Pump repair and service companies must now utilize coordinate measuring machines, CNC and CAD/CAM technology to compete.

Our company recently added state-of-the-art computational fluid dynamics software for the design of impellers, and upgraded our CAD software to solids modeling. We also added the capabilities to verify these new impeller designs through operational tests.

All of these tools not only enhance the quality of the product being produced, but also dramatically improve the response time on complex engineering design upgrades. To compete, companies must embrace these new technologies and develop innovative ways to apply them within their business.

The service business is increasingly a knowledge- and solution-based business. In this shift from “cutting metal” to providing solutions, engineering and specialized technical services play a critical role. Each replacement part or pump rebuild represents a potential opportunity to improve the operation and extend the life of the pump.

When you identify a problem pump, do you want a supplier who will simply replicate the part, or do you want a supplier that will help you improve the reliability of the equipment by analyzing the root cause of the problem and offering solutions to address that problem?

With fewer plant people and continued emphasis on both operational and financial results, equipment reliability must be a key focus. The ability of a supplier to deliver reliability on a consistent basis will become a more important factor in supplier selection in the future.

Pump repair and service is a somewhat fragmented market sector. Service centers – including those of the prominent OEMs – tend to work on various types of rotating equipment, such as compressors, turbines, blowers, etc. Other smaller companies focus on pumps as their core competency and add value by strengthening their capabilities and services in this arena. In addition to pump rebuilding, they offer pump upgrades, engineering, replacement parts, field services, pump testing and turnkey services.

These smaller firms also recognize there are specialized services that customers need that may not be practical to develop from within, so they develop alliances and/or partnering agreements with other well-established companies that offer complementary services or products.

An example of this is our alliance with Standard Alloys, an engineered parts supplier with ISO 9001:2000 certification and a long history of providing quality parts to the petroleum industry. With their own in-house foundry and pattern shop employing stereo-lithography and other current technologies, Standard Alloys provides castings (with documented certifications) in most of the major noble alloys, and rapid response for critical needs.

This type of relationship is not only an opportunity for growth, but also, more importantly, one which enables better service to customers.

Challenges

The age of “newer” power plants, refineries and other large industrial plants now range from 25 to 30 years – the edge of typical OEM guidelines for product support. Pumps ranging from 40 to 50 years are generally considered “obsolete.” Industry consolidations are also eliminating or “rationalizing” many overlapping product lines. In their place, OEMs are offering new pump designs.

To avoid the high capital cost of redesigning their pumping system, most companies prefer to maintain their existing equipment where possible. Since many of these pumps are still serviceable, companies should consider where the necessary support will come from. Because it is generally not practical or economically feasible for OEMs to support all of the legacy brands, qualified alternate suppliers fill an important need in providing parts, service and upgrades for this aging equipment.

As mentioned earlier, the strong market for new products, coupled with the greatly reduced number of foundries and global outsourcing of many pump components, often stretches deliveries for new products and replacement parts to unacceptable time frames. This challenge is a major concern for pump users.

The need for qualified workers in the aftermarket business continues to challenge both OEMs and engineered parts suppliers. At an economic briefing I attended in 2006, speakers from the power, petroleum and other major industries repeatedly raised this concern. After a hiatus of more than two decades, we are now experiencing resurgence in industrial development in the U.S., with a notable shortage in the supply of skilled craft labor and engineers. As a result, human resource planning and programs will become an important strategic component in our industry.

At one time, the entry barriers for engineered parts suppliers in the pump industry were relatively low. Service was provided at the local level, often by general machine shops with no particular expertise in pumps or knowledge of the metallurgy associated with making and/or rebuilding pump parts. Quality issues – often related to inappropriate metallurgy – were quite common and many engineered parts suppliers were discredited.

Suppliers that invested in and strengthened their capabilities and services and made quality their focus still must overcome the negative image of these early failures. Qualified parts suppliers can play an important role in the high demand for pump products and aftermarket services. The challenge for the

marketplace is in keeping an open mind and developing objective criteria for evaluating those suppliers.

I recently participated in several supplier audits by major companies in the power, petroleum and steel industries. I was very encouraged by their comprehensive and analytical approach to vendor qualification. They were willing to invest the time to visit our facilities and to audit our processes – from human resources to safety and shop floor practices.

They recognized that the right supplier can become a partner in their business and make an important contribution – beyond providing what is written on the purchase order.